In the ever-evolving digital landscape, a robust online presence has become an essential component of success for businesses of all sizes. For small businesses operating within the tax and accounting sector, a well-designed website is no longer a luxury—it’s an absolute necessity. This comprehensive guide delves into the critical reasons why having a tax and accounting website is indispensable for small businesses. We will also explore the essential features that should be included in such a website and how a strong online presence can significantly contribute to the overall success of your business.

Why Small Businesses Need a Tax and Accounting Website

Credibility and Professionalism

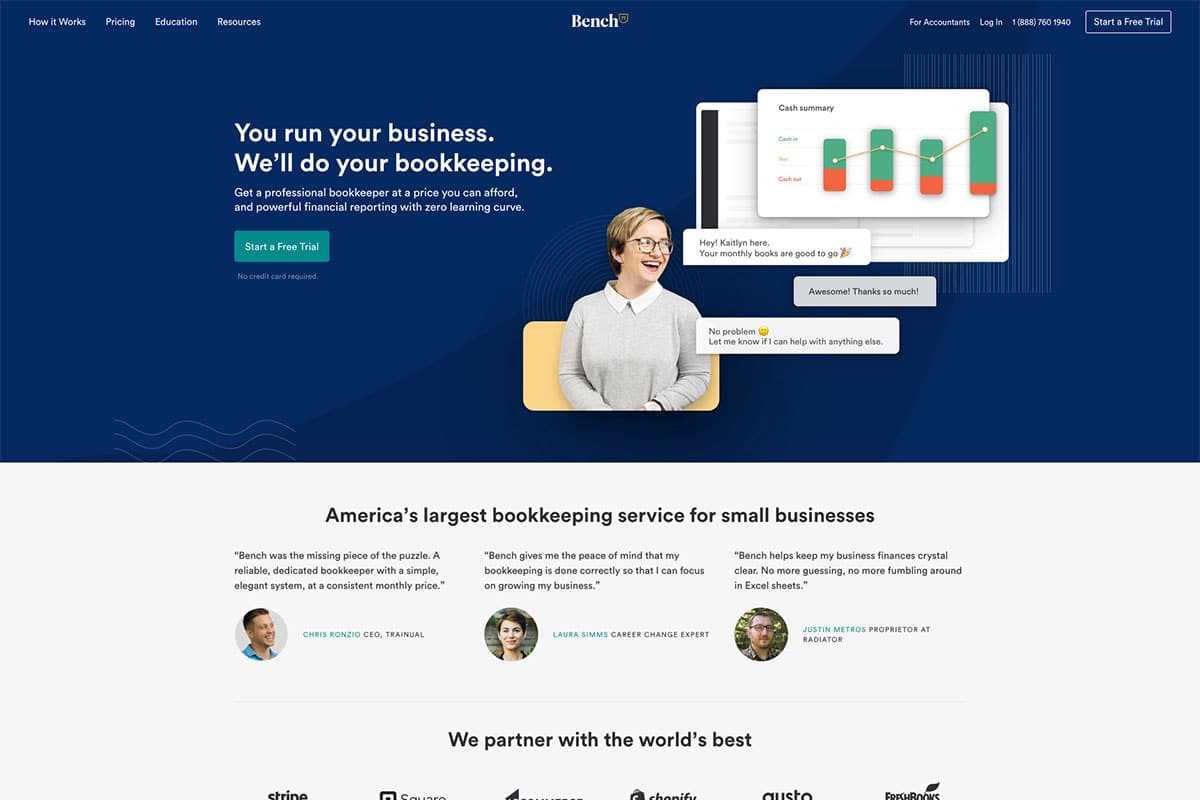

In today’s highly competitive market, establishing credibility and projecting professionalism is paramount for any business, especially for small firms in the tax and accounting sector. A well-crafted website serves as a digital storefront, instantly adding an aura of legitimacy to your business. When potential clients land on your website, the design, content, and overall user experience convey the quality of service they can expect. A professional website reassures clients that they are dealing with a competent and reliable firm, which is crucial in an industry where trust and accuracy are paramount. Moreover, a website with a polished and modern design stands out in a crowded marketplace, distinguishing your business from competitors who may not have invested in their online presence.

24/7 Accessibility

Unlike a traditional brick-and-mortar office that closes at the end of the business day, your website offers around-the-clock accessibility. This constant availability means that potential clients can explore your services, read client testimonials, and even initiate contact at their convenience, regardless of the time of day or night. For small businesses, this 24/7 accessibility can be a game-changer, as it allows you to reach and engage with clients who might otherwise have been out of reach due to time constraints or geographical limitations. By providing this level of convenience, your website becomes a powerful tool for generating leads, answering questions, and nurturing client relationships, all without the need for continuous manual intervention.

Targeted Marketing

One of the most significant advantages of having a tax and accounting website is the ability to implement targeted marketing strategies. A website allows you to tailor your content and marketing efforts to reach specific audiences, particularly those actively searching for tax and accounting services in your local area. By utilizing SEO (Search Engine Optimization) techniques, including local search optimization, you can increase your website’s visibility in search engine results, making it easier for potential clients to find your business. Targeted marketing also allows you to create personalized content and offers that resonate with your audience, ultimately leading to higher conversion rates and a more efficient marketing spend.

Client Convenience

In an era where convenience is king, clients increasingly expect easy access to the information and services they need. A well-designed website can provide this convenience by offering essential information such as your services, pricing, and contact details in an easily accessible format. Furthermore, by integrating advanced features like online appointment booking systems, secure client portals for document exchange, and downloadable tax forms, you can significantly enhance the client experience. These features not only save time for both you and your clients but also demonstrate your commitment to providing a seamless and efficient service, which can be a deciding factor for clients when choosing a tax and accounting firm.

Key Features of a Successful Tax and Accounting Website

User-Friendly Design

The design of your website plays a crucial role in the user experience and can greatly impact how potential clients perceive your business. A user-friendly design ensures that visitors can easily navigate your site, find the information they need, and take the desired actions, such as contacting you or scheduling an appointment. To achieve this, your website should have a clean and intuitive layout, with a simple menu structure that allows users to find what they’re looking for without frustration. Clear headings, well-organized content, and an effective search function are also key elements of a user-friendly design. By prioritizing ease of use, you not only improve the visitor experience but also increase the likelihood of converting those visitors into clients.

SEO Optimization

Search Engine Optimization (SEO) is a critical component of any successful website, particularly for small businesses looking to increase their online visibility. An SEO-optimized website is more likely to rank well in search engine results, making it easier for potential clients to find you when searching for tax and accounting services. Effective SEO involves a combination of factors, including the use of relevant keywords, high-quality content, and ensuring that your site is mobile-friendly. Additionally, local SEO is particularly important for small businesses, as it helps you attract clients within your geographic area. This can be achieved by including your location, service area, and locally relevant keywords in your content. By investing in SEO, you can enhance your website’s visibility, attract more traffic, and ultimately grow your client base.

Compelling Content

Content is often referred to as the backbone of a website, and for good reason. The content on your site not only informs and educates visitors but also plays a significant role in building trust and establishing your authority in the tax and accounting field. Your website should feature well-crafted, informative content that addresses the specific needs and concerns of your target audience. This could include blog posts offering tax tips, frequently asked questions (FAQs), detailed service descriptions, and client testimonials. Regularly updating your content is also essential, as it helps improve your SEO rankings and keeps your audience engaged. By providing valuable and relevant content, you can position your firm as a trusted resource, encouraging visitors to choose your services over those of your competitors.

Secure Client Portals

In the tax and accounting industry, security is a top priority for clients, especially when it comes to handling sensitive financial information. Your website should include a secure client portal where clients can upload and download documents, communicate with your team, and access their account information safely. Implementing strong security measures, such as encryption and two-factor authentication, not only protects your clients’ data but also builds trust in your firm’s ability to safeguard their information. A secure client portal adds a layer of professionalism and convenience to your services, allowing clients to manage their financial matters with confidence, knowing that their data is in safe hands.

Call to Action

A Call to Action (CTA) is a critical element of your website, as it guides visitors towards taking specific actions that align with your business goals. Whether it’s scheduling a consultation, downloading a free guide, or signing up for a newsletter, every page on your website should include a clear and compelling CTA. The placement, design, and wording of your CTAs can significantly impact their effectiveness. To maximize conversions, CTAs should be strategically placed in prominent locations, such as at the end of blog posts or on service pages, and should use action-oriented language that encourages visitors to take the next step. By incorporating well-crafted CTAs throughout your site, you can drive engagement, capture leads, and ultimately increase your client base.

Mobile Responsiveness

As more people access the internet from their mobile devices, having a mobile-responsive website has become essential. A responsive design ensures that your website looks and functions well on all screen sizes, providing a seamless experience for users regardless of the device they’re using. This is particularly important for small businesses, as mobile users now make up a significant portion of web traffic. A mobile-responsive website not only improves user experience but also positively impacts your SEO rankings, as search engines like Google prioritize mobile-friendly sites. By ensuring that your website is fully responsive, you can cater to the growing number of mobile users, enhance your online presence, and stay competitive in the digital marketplace.

The Benefits of Website for Your Tax and Accounting Business

Increased Visibility

In today’s digital-first world, increasing your business’s visibility online is crucial for attracting new clients and growing your firm. A well-optimized website can significantly boost your online presence, making it easier for potential clients to discover your services through search engines, social media, and other online platforms. For small businesses, increased visibility means more opportunities to connect with clients who might not have found you through traditional marketing channels. By focusing on SEO, content marketing, and social media integration, you can amplify your reach, attract a wider audience, and establish your firm as a leading provider of tax and accounting services in your area.

Lead Generation

Your website is more than just a digital brochure; it’s a powerful tool for generating leads and converting them into clients. By offering valuable resources, such as eBooks, tax calculators, or informative blog posts, you can capture the contact information of visitors who are interested in your services. These leads can then be nurtured through targeted email marketing campaigns, personalized follow-ups, and exclusive offers, increasing the likelihood of conversion. Lead generation is particularly effective when combined with SEO and content marketing, as it attracts qualified prospects who are actively seeking the services you provide. By leveraging your website as a lead generation tool, you can build a steady pipeline of potential clients, ensuring the long-term growth of your business.

Client Retention

While attracting new clients is important, retaining existing ones is equally, if not more, crucial for the success of your business. A well-maintained website can play a significant role in client retention by providing ongoing value and keeping clients engaged with your firm. Regularly updated content, such as blog posts on the latest tax law changes, newsletters with useful tips, and exclusive client offers, can help you stay top-of-mind with your clients. Additionally, features like secure client portals, online appointment scheduling, and personalized account dashboards enhance the client experience, making it easier for clients to manage their finances and communicate with your team. By focusing on client retention through your website, you can build lasting relationships, increase client loyalty, and encourage repeat business.

Competitive Advantage

In the tax and accounting industry, many small firms still rely on word-of-mouth referrals and traditional advertising methods. While these approaches can be effective, they often fall short in today’s digital age, where clients increasingly turn to the internet to find and evaluate service providers. By investing in a professional, well-optimized website, you can gain a significant competitive advantage over firms that have not yet embraced the digital transformation. A strong online presence not only helps you reach a wider audience but also positions your firm as a modern, forward-thinking business that is committed to providing top-notch service. This competitive edge can be the difference between winning or losing a potential client, especially in a crowded marketplace.

Conclusion

In conclusion, a tax and accounting website is not just a valuable asset—it’s an essential tool for small businesses looking to thrive in today’s competitive landscape. A well-designed website enhances your credibility, increases your accessibility, and serves as a powerful marketing tool that can drive significant growth for your firm. By focusing on key elements such as user-friendly design, SEO optimization, compelling content, and client convenience, you can create a website that attracts new clients, retains existing ones, and sets your business apart from the competition. In a world where digital presence is increasingly tied to business success, investing in a strong, professional website is no longer optional—it’s a critical step towards ensuring the long-term success and sustainability of your tax and accounting business.