Why Accountants Need a Website

Credibility: In an age where clients often start their search for services online, a website is a critical component of your firm’s credibility. It’s often the first point of contact for potential clients, and a professional website instantly communicates that you are a legitimate, trustworthy business. Without one, potential clients may question your professionalism or even doubt your firm’s existence.

Accessibility: Your website acts as a 24/7 portal where clients can learn about your services, read client testimonials, and contact you. Unlike a physical office that has operating hours, a website is always open, allowing potential clients to explore your offerings at their convenience. This accessibility is particularly important for busy professionals who may only have time to search for an accountant outside of regular business hours.

Marketing: A website is your most valuable marketing tool. It allows you to reach a broader audience, share your expertise through blogs or articles, and engage with potential clients through various digital channels. Your website is also the foundation for other online marketing efforts, such as email marketing, social media, and search engine optimization (SEO).

Client Education: One of the most valuable functions of your website is client education. By providing resources like articles, whitepapers, and FAQs, you can help your clients make informed decisions about their finances. Educating your clients not only positions you as an expert in your field but also builds trust and loyalty.

Key Elements of an Accountant’s Website

Creating a website that effectively represents your accounting firm involves more than just choosing a template and filling in the blanks. It requires careful consideration of the elements that will make your site both functional and appealing to potential clients. Below are the key components that every accountant’s website should include:

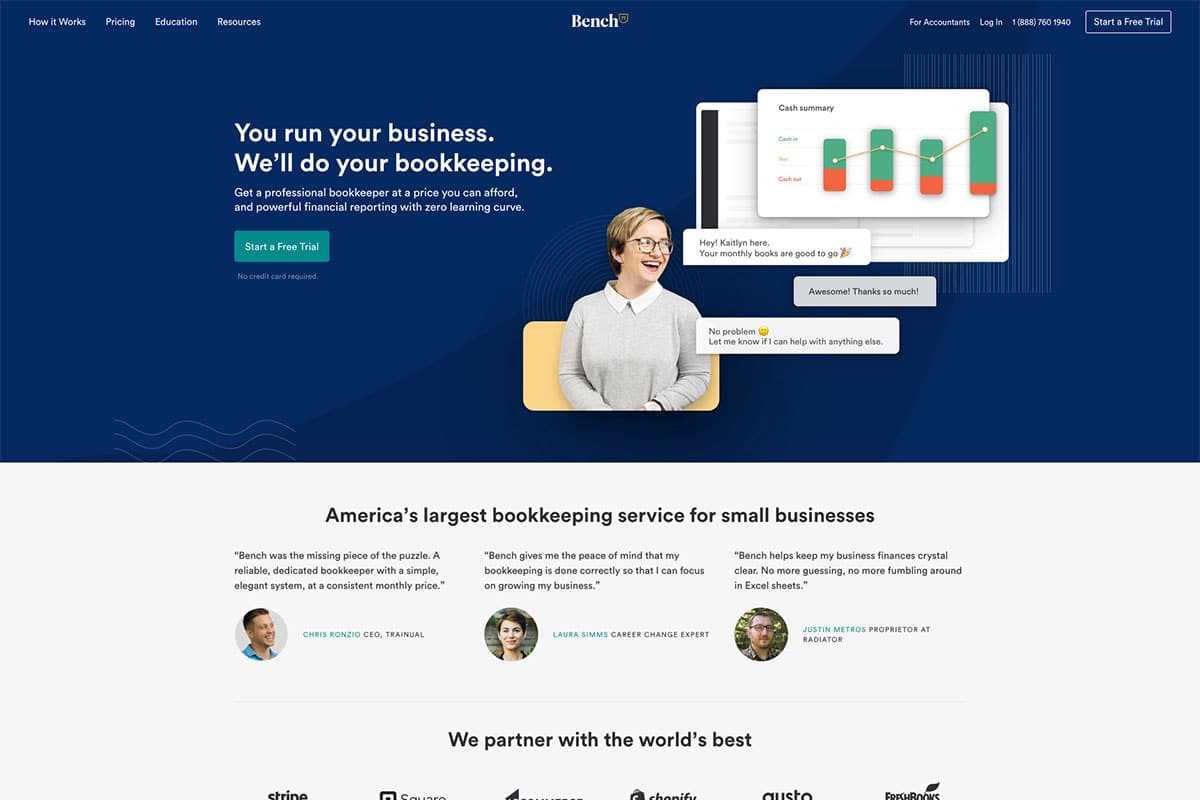

Clean, Professional Design: Your website’s design should reflect the professionalism and reliability of your firm. A clean, uncluttered design with a logical layout and easy-to-navigate structure is essential. Avoid overly complex designs or flashy elements that could distract from the main purpose of the site—conveying your expertise and services clearly.

Mobile Responsiveness: With more than half of all web traffic coming from mobile devices, ensuring your website is mobile-friendly is non-negotiable. A responsive design adjusts to different screen sizes, ensuring that your site looks and functions well on smartphones, tablets, and desktops alike. A mobile-friendly site enhances user experience and can also improve your search engine rankings.

Services Offered: Clearly outlining the services you provide is crucial. Whether you specialize in tax preparation, bookkeeping, audit services, or financial consulting, each service should be described in detail. Consider including examples of how your services have benefited clients or case studies that highlight your expertise in solving specific financial challenges.

Client Testimonials: Testimonials are powerful tools for building trust and credibility. Including quotes or short stories from satisfied clients can reassure potential clients that they are making the right choice by working with you. Make sure to update these regularly and consider featuring testimonials that address different services or client needs.

Contact Information: Your contact information should be easy to find and accessible from every page of your website. In addition to a contact form, include your email address, phone number, and physical address if applicable. For added convenience, consider integrating tools like live chat or appointment scheduling software that allows clients to book consultations directly through your site.

Blog Section: A blog is an excellent way to keep your website dynamic and engaging. Regularly publishing blog posts on relevant topics—such as tax tips, financial planning advice, or updates on changes in tax law—can help you connect with your audience, improve your SEO, and position your firm as an industry leader. Blogging also provides an opportunity to showcase your expertise and offer value to both current and potential clients.

Call-to-Action (CTA): A strong Call-to-Action (CTA) encourages visitors to take the next step, whether that’s contacting you for a consultation, signing up for your newsletter, or downloading a free guide. Your CTAs should be clear, compelling, and strategically placed throughout your site to guide visitors toward conversion.

Designing for Your Audience

Know Your Audience: Start by identifying who your ideal clients are. Are they small business owners, individual taxpayers, or perhaps large corporations? Knowing your audience will help you craft content and design elements that address their specific needs and pain points. For instance, if you specialize in small business accounting, your website might focus on issues like cash flow management, tax planning for entrepreneurs, or navigating business deductions.

Tone and Style: Your website’s tone should align with your brand identity. If your firm is known for its formal, no-nonsense approach, your website should reflect that with a professional, straightforward tone. On the other hand, if your firm prides itself on being approachable and client-friendly, you might use a more conversational tone with warm, inviting language. The style of your website—colors, fonts, and imagery—should also align with the message you want to convey.

Content That Resonates: Tailor your content to address the specific concerns of your audience. For example, if your target clients are individuals, you might focus on content related to personal finance, retirement planning, or tips for maximizing tax refunds. For business clients, consider content that discusses business tax strategies, financial forecasting, or compliance issues. The more relevant your content is to your audience, the more likely they are to engage with your site and seek out your services.

SEO: Getting Found Online

Keyword Optimization: Keywords are the terms and phrases that potential clients might use when searching for accounting services online. Incorporating these keywords into your website’s content, headings, meta descriptions, and URLs can help improve your site’s visibility in search results. For example, keywords like “small business tax accountant,” “personal financial planning,” or “CPA firm in [Your City]” can help attract the right audience to your site.

Local SEO: If your accounting firm serves a specific geographic area, local SEO is essential. This involves optimizing your website for local search terms, such as “accounting services in New York” or “tax advisor near me.” In addition to including your location in your content and meta tags, you should also create a Google My Business profile, which can help your firm appear in local search results and on Google Maps.

High-Quality Content: Content is king when it comes to SEO. Search engines favor websites that regularly publish high-quality, original content. By maintaining a blog with informative and relevant articles, you can improve your site’s ranking and attract more visitors. Topics might include “Top Tax Deductions for Small Businesses,” “Understanding the New Tax Laws,” or “How to Prepare for an Audit.”

Meta Tags and Descriptions: Each page on your website should have a unique meta title and description that accurately reflects the content while incorporating relevant keywords. These tags not only help search engines understand what your page is about but also influence whether users click on your site in search results.

Backlinks: Backlinks—links from other reputable websites to yours—are another important factor in SEO. Earning backlinks from industry websites, blogs, or local directories can boost your site’s authority and improve its ranking in search results. Consider guest blogging, participating in industry forums, or getting listed in online directories as ways to build valuable backlinks.

The Importance of Security

HTTPS and SSL Certificates: The first step in securing your website is implementing HTTPS, which encrypts the data exchanged between your website and its visitors. To enable HTTPS, you’ll need to install an SSL (Secure Sockets Layer) certificate. This not only protects sensitive information but also signals to visitors that your site is secure, which can increase trust and reduce bounce rates.

Secure Client Portals: If your website includes a client portal where clients can upload documents, access their accounts, or communicate with you, ensuring the security of this portal is critical. Use strong encryption protocols and multi-factor authentication to protect client data. Regularly audit your security measures and update them as needed to address new threats.

Regular Security Updates: Cyber threats are constantly evolving, so it’s important to keep your website’s software, plugins, and systems up to date. Regularly installing security patches and updates helps protect your site from vulnerabilities that could be exploited by hackers. Consider working with a professional web developer or IT specialist to ensure your website remains secure.

Privacy Policy: Include a clear and comprehensive privacy policy on your website. This policy should explain how you collect, use, and protect client data. A well-crafted privacy policy not only complies with legal requirements but also builds trust with your clients by demonstrating your commitment to safeguarding their information.

Maintaining Your Website

Content Updates: Keeping your content fresh and relevant is crucial for maintaining user engagement and SEO performance. Regularly update your website with new blog posts, case studies, client testimonials, and updates to your services. This not only helps your site stay relevant but also signals to search engines that your website is active, which can improve your rankings.

Security Updates: As mentioned earlier, keeping your website’s software, plugins, and systems up to date is vital for security. Regularly check for and install updates to protect your site from vulnerabilities. Consider setting up automatic updates for critical components, but always test these updates to ensure they don’t cause issues with your site’s functionality.

Performance Checks: Regularly monitoring your website’s performance is essential for providing a good user experience. Use tools like Google PageSpeed Insights to test your site’s load times, and address any issues that may be causing slowdowns. Also, ensure your site is mobile-friendly and accessible to users with disabilities, which can improve both user experience and SEO.

Client Interaction: Your website should facilitate easy and efficient communication with your clients. Regularly test contact forms, chat features, and appointment scheduling tools to ensure they are working correctly. Promptly respond to inquiries and keep your contact information up to date to maintain strong client relationships.

Conclusion: Your Digital Doorway

Remember, your website is not just a static brochure—it’s a dynamic tool that can help you grow your business, build trust with clients, and establish your firm as a leader in the accounting industry. Keep it updated, relevant, and focused on your clients’ needs, and it will serve as a powerful asset in achieving your business goals.